Update: AMD’s Acquisition of Xilinx Receives Regulatory Go, Deal Closes At $49B

by Ryan Smith on February 14, 2022 9:30 AM EST

Update 02/14: AMD has sent out a brief statement this morning announcing that the Xilinx deal has formally closed. AMD has now fully acquired Xilinx. The final value of the deal, based on AMD's stock price at the closing, was $49B. Which according to AMD is the largest semiconductor acquisition in history.

Original Story, 02/10:

Although it’s taken a bit longer than planned, AMD’s acquisition of Xilinx has finally cleared the last regulatory hurdles. With the expiration of the mandatory HSR waiting period in the United States, AMD and Xilinx now have all of the necessary regulatory approval to close the deal, and AMD expects to complete its roughly $53 billion acquisition of the FPGA maker on or around February 14th, 2 business days from now.

Having previously received approval from Chinese regulators late last month, the final step in AMD’s acquisition of Xilinx has been waiting out the mandatory Hart-Scott-Rodino (HSR) Act waiting period, which gives US regulators time to review the deal, and take more action if necessary. That waiting period ended yesterday, February 9th, with no action taken by the US, meaning that the US will not be moving to block the deal, and giving AMD and Xilinx the green light to close on it.

With all the necessary approvals acquired, AMD and Xilinx are now moving quickly to finally consummate the acquisition. AMD expects to complete that process in two more business days, putting the closure of the deal on (or around) February 14th – which is fittingly enough Valentine’s Day.

16 months in the making, AMD’s acquisition of Xilinx is the biggest acquisition ever for the Texas-based company. The all-stock transaction was valued at $35 billion at the time the deal was announced, offering 1.7234 shares of AMD stock for each Xilinx share. Since then, AMD’s stock price has increased by almost 51% to $125/share, which will put the final price tag on the deal at close to $53 billion – which is almost a third of AMD’s entire market capitalization and underscores the importance of this deal to AMD. Once the deal closes, Xilinx’s current stockholders will find themselves owning roughly 26% of AMD, while AMD’s existing stockholders hold the remaining 74%.

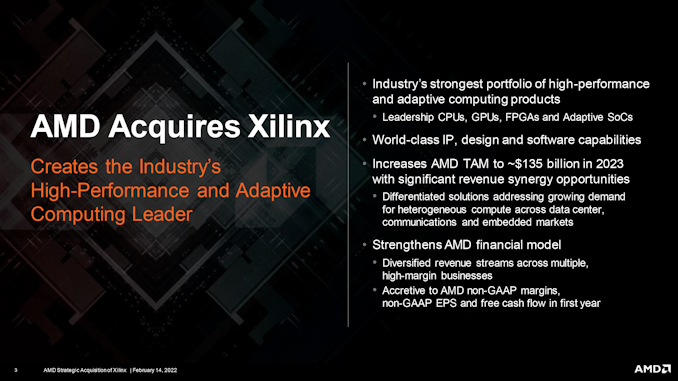

Having rebounded from their darkest days last decade, AMD has since shifted into looking at how to further grow the company, both by increasing its market share in its traditional products like CPUs and GPUs, as well as by expanding into new markets entirely. In particular, AMD has turned its eye towards expanding their presence in the data center market, which has seen strong and sustained growth for virtually everyone involved.

With AMD’s recent growth in the enterprise space with its Zen-based EPYC processor lines, a natural evolution one might conclude would be synergizing high-performance compute with adaptable logic under one roof, which is precisely the conclusion that Intel also came to several years ago. To that end, the high-performance FPGA markets, as well as SmartNICs, adaptive SoCs, and other controllable logic driven by FPGAs represent a promising avenue for future growth for AMD – and one they were willing to pay significantly for.

Overall, this marks the second major industry acquisition to be resolved this week. While NVIDIA’s takeover of Arm was shut down, AMD’s acquisition of Xilinx will close out the week on a happier ending. Ultimately, both deals underscore just how lucrative the market is for data center-class processors, and to what lengths chipmakers will go to secure a piece of that growing market.

Source: AMD IR

34 Comments

View All Comments

mode_13h - Sunday, February 13, 2022 - link

> How about intelligent comments?Try making some yourself and maybe others will reply in kind.

Also, note that neither pomposity is not a substitute for intelligence. Nor are unconventional points of view, at least if they're not well-supported by facts and sound reasoning.

Reflex - Saturday, February 12, 2022 - link

Nah, lots of us are capable of reading quarterly results and understand how strapped the company was at the time and that they made the strategic choice to invest on the CPU side rather than GPU since they didn't have resources for both.Also, some of us know people at AMD. Your conspiracy is dumb and ignores reality.

Oxford Guy - Saturday, February 12, 2022 - link

Your use of conspiracy in this context exposes the superficiality of your understanding. I understand that glibly and incessantly dropping that buzzword is supposed to have cachet but corporations are themselves conspiratorial. That’s a simple fact that flies right over the heads of our pious Pollyannas.Ambrose Bierce is famous, in part, for exposing the corporation (and, of course, the ‘class’ of people who invented them and use them) with his definition. Since he’s dead, taunting him with the ‘conspiracy theory’ dead horse probably won’t get him to retract his words.

Spending time imagining kindness from corporations that put the FX 9590 on the market may be a way to cope with the vicious inhumanity of the corporate system but it’s folly.

mode_13h - Sunday, February 13, 2022 - link

> Your use of conspiracy in this context exposes the superficiality of your understanding.A rebuttal like that is basically as good as ceding the argument.

> Ambrose Bierce is famous, in part, for exposing the corporation

Okay, so then any cynical take on corporate behavior must therefore necessarily be true?

Perhaps you should take a class on logic or formal reasoning.

> imagining kindness from corporations that put the FX 9590 on the market

It was a bad product, made out of desperation. They probably regret having done it, not least because it wasn't very successful for them.

Kindness doesn't even factor into it. If you look at the commercial success it had (or lack thereof) and reputational impact, then you can understand why they would probably regret doing it, or at least having been in a position where they did it.

TheinsanegamerN - Monday, February 14, 2022 - link

I think you're missing a huge part of that context: it was the rebrandeon years of GCN that helped lead to AMD having no money. Some GCN hardware was sold under the 400 series branding even, the 500 series had them! It wouldnt be until 2019 and the rDNA launch that GCN 1.0 (from 2011) was finally retired.AMD ha smade many bad decisions. Many may also remember evergreen getting the rebrandeon treatment with the 6000 series, only to get BTFOd by thermi 2.0.

erinadreno - Friday, February 11, 2022 - link

Xilinx normally don't release new FPGAs every year. They aren't consumer electronics, they are development equipment.flgt - Friday, February 11, 2022 - link

Yeah, which makes you wonder why AMD thought this was a good deal. Data center has enough volume to justify ASIC’s which FPGA’s can’t compete against. I don’t see any synergies in this deal. Maybe tools and software? Xilinx has thrived since Altera has been mismanaged by Intel in recent years. There will be pressure to make some sort of integrated product which will draw focus and resources away from each companies core business.alfalfacat - Friday, February 11, 2022 - link

AMD stock is at an all-time high and trading at stratospheric earning multipliers. An all-stock deal means AMD buys a profitable business without paying a single cent. It's a reasonably decent corporate strategy move, even if they do nothing else with Xilinx (admittedly unlikely).flgt - Friday, February 11, 2022 - link

Well AMD shareholders pay plenty when their equity is diluted. You could just own stock in both if you wanted to leave Xilinx alone and liked their respective management team. These deals always have to be predicated on 1+1=3. That could be killing off competition so you can raise prices. Or it can be a technology enabler for a product that will take market share. I just don't see either happening given the markets the two companies play in. The problem I see with FPGA's is they will always have a brick wall limiting their growth. Once the market gets big enough customers will choose the cost and performance advantages of ASIC's over the configurability of FPGA's. At that point FPGA sales tend toward zero. FPGA companies need to be tailored to cater to all the niche applications where they excel.whatthe123 - Friday, February 11, 2022 - link

depends on the outlook. retail investors are generally nuts and believe it's reasonable for decades of forward profits to get priced on now so they can get rich. institutional investors are more realistic and probably see the gigantic multiple on AMD's stock signalling its overvalued and a good time to spend stock on acquisitions. Underestimating the stock's growth and buying too early is a lot less risky than overestimating and completely losing the chance at a merger if the value drops too far.