EVGA and NVIDIA To Split: EVGA Won’t Make Next-Gen NVIDIA Cards

by Ryan Smith on September 16, 2022 8:00 PM EST

In a move that will have significant repercussions for the video card industry in North America and Europe, EVGA today has announced that the company is parting ways from NVIDIA. As a result, the company will not be producing video cards based on NVIDIA’s next-generation of GPUs – and won’t be immediately switching allegiance to AMD or Intel, either. Consequently, NVIDIA is losing their largest add-in board (AIB) in North America, and the broader North American video card market is losing one of its biggest and best-known vendors.

In a brief announcement posted on EVGA’s forums, the company outlined their parting from NVIDIA, while underscoring that this affects the next-generation of video cards, and that EVGA will continue to provide current-gen products and support existing customers.

- EVGA will not carry the next generation graphics cards.

- EVGA will continue to support the existing current generation products.

- EVGA will continue to provide the current generation products.

EVGA is committed to our customers and will continue to offer sales and support on the current lineup. Also, EVGA would like to say thank you to our great community for the many years of support and enthusiasm for EVGA graphics cards.

EVGA Management

Meanwhile, in a briefing attended by Jon Peddie Research and Gamers Nexus, EVGA’s CEO (and founder) Andrew Han laid out some further details about the transition. These are both great pieces and as I’m not going to simply rehash them point by point, I’d encourage readers looking for a first-hand recounting of the briefing to check them out.

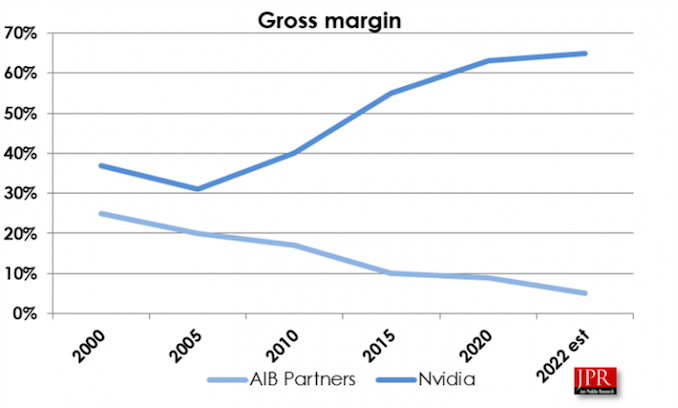

As laid out in both pieces, EVGA’s parting from NVIDIA comes as the company’s relationship with NVIDIA has, according to EVGA, soured over the years. Most notably, AIB margins have been slowly shrinking over the past couple of decades, with JPR publishing that gross margins at the AIB partners have fallen from 25% in 2000 to 10% in 2015, and finally an estimated 5% this year. Meanwhile, as NVIDIA has slowly ramped up its own efforts to directly sell its Founders Edition (reference) video cards in Best Buy and other retailers, AIBs like EVGA have been put in a position of directly competing with their partner-turned-supplier.

Jon Peddie Research: AIB Gross Margins v. NVIDIA Gross Margins

This, in turn, has put EVGA in a position where they are taking a loss on selling high-end NVIDIA cards, a significant shift from what are normally the highest margin products sold by video card vendors. And while consumers are benefitting from this in the short term via cheaper video cards, taking a loss of hundreds of dollars per video card is not sustainable – nor is it a viable business practice to begin with.

As a result of these factors (and undoubtedly more tales known only between EVGA and NVIDIA) EVGA has opted to part ways from NVIDIA. This means that EVGA will not be selling video cards based on NVIDIA’s next generation of GPUs, and that EVGA is ramping down production of existing GeForce RTX 30 series cards. According to Gamers Nexus, EVGA expects to run out of current-generation cards for retail by the end of the year, with the company setting aside a remainder of those cards as spares to honor warranty obligations.

EVGA RTX 3090 Ti FTW3: A Money-Losing Product

Perhaps equally notable, EVGA has also made it clear that they are not immediately partnering with a competing GPU vendor, either. So for the moment, at least, this is not going to be a case of EVGA switching allegiances to AMD or Intel. Instead, EVGA is going to be out of the video card market for an indefinite period of time. To be sure, according to GN and JPR, the company has not completely closed the door on partnering with another GPU vendor, but they also aren’t actively pursing the matter right now.

And while this marks a massive cut to EVGA’s business – Gamers Nexus reports that video cards represent 80% of EVGA’s revenue – EVGA is not going out of business. The company still has a successful and well-regarded power supply business, as well as a more niche presence in high-end motherboards and gaming peripherals. This also means that EVGA will continue supporting its existing video card customers even once their remaining video card stockpile runs out, as the company still wants to maintain its sterling reputation for customer service.

Commentary: A Big Loss for Consumers, and a Opening the Door To Vertical Integration

EVGA’s exit from the video card industry represents what is easily the biggest shift in the retail video card landscape in over a decade. EVGA is not the first NVIDIA partner to part ways with the company – BFG and XFX were both major NVIDIA partners back in the 00s as well – but EVGA’s exit would seem to be the biggest yet. According to JPR, EVGA held 40% of the North American retail market, and they were a sizable player in Europe as well. EVGA was NVIDIA’s de facto premiere partner in the west, both in terms of total video card volumes and in terms of mindshare, with a legacy of producing high quality video cards backed with some of the best support in the industry.

As a result, EVGA’s exit is a big loss for consumers and video card enthusiasts overall. While NVIDIA can (and undoubtedly will) shift allocations over to their remaining AIB partners – Zotac is arguably the next best-known NVIDIA-exclusive vendor in North America – this still represents a reduction in competition in video card designs, especially with premium products where EVGA did some of their best work. And none of the remaining AIBs have a reputation for support that matches EVGA’s (though to be sure, reputation isn’t necessarily representative of the real world).

EVGA's Immediate Future: More Mobos and PSUs

But the full impact to the consumer market is going to hinge on what NVIDIA does next. From EVGA’s briefing it’s clear that there has been some friction between the two companies for quite some time, so while these revelations are new to outsiders, internally the businesses have been at odds for a while now. That means NVIDIA had plenty of time to prepare for EVGA’s split (they were first informed in April), and NVIDIA already has their own retail operations.

In fact, it’s those retail operations that seem to have led the way to what’s happening today. It wasn’t until the Pascal generation/GTX 10 series (2016) that NVIDIA began selling its own retail cards; for the 20 years before that, NVIDIA relied on AIBs to move its products. And even after that point, NVIDIA has purposely limited its reach by only selling cards directly, and later just through Best Buy.

Still, I’ve long wondered how AIBs have felt about NVIDIA going into competition with their own board partners, and now we have an answer, it would seem. EVGA is being driven out in part by NVIDIA’s direct presence on the market, with their Founders Edition cards undercutting EVGA’s products in price. It’s a relationship that by its very nature puts AIBs like EVGA at a disadvantage, as NVIDIA has the better brand recognition (all cards are NVIIDA cards) and much of NVIDIA’s R&D is paid for by their internal need for reference cards. This means that AIBs face additional costs on top of buying hardware from NVIDIA, especially if they want to go for premium designs like EVGA has been apt to do.

In short, NVIDIA’s decision to directly sell video cards, whether intentional or not, is putting the squeeze on AIBs. And NVIDIA-exclusive AIBs like EVGA are the most vulnerable.

EVGA’s exit from the video card market, in turn, opens the door to larger changes in video card manufacturing and distribution. Video card complexity has increased significantly over the years, and consequently so have the R&D costs at every single level. GPUs aren’t just getting more advanced, but they need ever finer PCB routing for memory, more advanced VRMs, bulked up cooling, and more. It’s not unlike the fab market, where every generation ups the ante on costs and discourages the kind of competition that results in lower prices, lower margins, and the inability to afford to play in the next generation of the game.

All of this, in turn, is making vertical integration look more and more appealing. While the AIBs in one form or another have played pivotal roles in the video card market since the dawn of the PC era, offering retail reach and support that the GPU vendors didn’t have or didn’t want to bother with, the actual value they add is, unfortunately, diminishing. Video cards are becoming so complex that, especially at the high end, the best move may very well be to stick with the reference designs. All of which further reduces the value (and uniqueness) AIBs can provide.

EVGA's Experiments Haven't Always Panned Out...

In short, this may be the moment where we see video card production pivot to having the GPU vendors themselves sell their cards, without the use of AIBs. So rather than having 10 video cards within a generation and then numerous AIB variations thereof – as is the case now with NVIDIA’s GeForce RTX 30 series – we’d have something more akin to desktop CPUs where there’s a dozen or so SKUs provided directly by the manufacturer.

Of course, this has been tried once before, with disastrous results (kids, go ask your parents about 3dfx), so it’s not by any means a sure-fire thing. But EVGA’s departure opens the door to NVIDIA to swoop in and take back 40% of their retail market for themselves, if that’s what they want.

And if NVIDIA doesn’t fill in the gap, then NVIDIA’s remaining AIBs will no doubt be happy to do it. The volume vacuum from EVGA’s exit means almost half the NVDIIA North American video card market is up for grabs. It is a huge opportunity to reshape that landscape and grab the kind of market share that would take years and years to peel away under more normal circumstances. So although a dark day for EVGA, opportunity knocks for the AIBs who remain.

The next-biggest question at this point is whether EVGA will remain in the video card market at all. From the Gamers Nexus and JPR articles it’s clear that EVGA is not keen on immediately jumping back in with a different partner. And, given that the Ethereum Merge just went through this week and video cards across the globe were liberated from their inane toiling (read: Ethereum is no longer relying on proof-of-work for blockchain processing), now is not the time to be making any firm plans.

The broad expectations of the industry are that all of these former mining cards are going to be boomeranging back on to the used video card market, similar to the last crypto hangover but in even larger volumes due to the much longer period this most recent mining boom went on. So the video card market is going to be dealing with an oversupply as it is, meaning that it’s not going to be a great time to be producing more video cards, as even next-gen cards below the flagship level will be competing with their predecessors.

So even if EVGA does ultimately opt to get back in to video cards – and I hope they do – sitting things out while the market corrects itself and digests the sudden surge of used cards is a prudent move. How long all of that will take remains to be seen, but as the current situation took years to get into, it won’t be a fast fix coming back out. In time, it would be a feather in either AMD or Intel’s cap to line up EVGA as a partner, as they bring a level of sophistication and respect that none of their current AIBs possess. Though it should be noted that the overall GPU market share is so significantly tilted in NVIDIA’s favor right now – a 4:1 ratio – that at former production levels EVGA could probably absorb most of the AMD retail market presence, something AMD’s other AIBs would no doubt be unhappy with.

Unfortunately, this exit also underscores how exposed EVGA is in the video card market, since video card sales were 80% of its revenue. The company has other product lines, but these are smaller in volume and all in product categories that are even more commoditized than video cards.

Over the Years EVGA Has Gone Big Into PSUs, In More Ways Than One

EVGA, for its part, has certainly made efforts to diversify over the years, but with limited success. Almost a decade ago I was fortunate enough to be at a business dinner with EVGA and Anand, where Andrew Han asked for our feedback on what sorts of products we thought would be good markets for EVGA to expand into. We ended up making several suggestions, but as today’s EVGA product mix shows, EVGA never found a second market on the same order of magnitude as video cards. Consequently, I’m not surprised to see Gamers Nexus report that EVGA is not planning on expanding into new product categories in the near future; that’s not something they’ve had luck with in better times, never mind going into this likely recession.

Ultimately, while today’s news marks a seismic shift in the video card landscape, it’s also the kind of news where there’s no way to put a positive spin on it. The video card market, for its part, will keep moving right along without EVGA, but the market and consumers are all the worse for EVGA’s departure. Thankfully, this is not EVGA’s eulogy – the company is still staying in business – but I sincerely hope that when we talk about EVGA in the future, it will be for more than just motherboards and PSUs. Video cards are were EVGA has made its name, and it’s still where EVGA does some of its best work.

119 Comments

View All Comments

Byte - Monday, September 19, 2022 - link

I like AMD as much as the next fanboy, but Nvidia GPUs outnumber them more than 9-1. EVGA on top sells like 40%+ of nvidia cards. I don't think going to team red and blue will help EVGA much. For now it looks like they are staying in the sidelines until a successor can figure out what to do.Bruzzone - Monday, September 19, 2022 - link

Nvidia controls 50% of GA final produced goods so if EVGA controlled 40% of the independent products THAT IS A TOTALLY HUGE ANTIYRUST VIOLATION. Thank you for the note. mbDigitalFreak - Friday, September 16, 2022 - link

Sad thing is that back in the day, Anandtech would have been one of the sites invited to the "secret meeting" that Gamers Nexus and Jayz went to with the EVGA CEO.Byte - Saturday, September 17, 2022 - link

If kids nowadays could read, that is.nandnandnand - Sunday, September 18, 2022 - link

https://www.jonpeddie.com/news/evga-wont-offer-nvi...An old man with a blog got in, but not Anandtech.

GeoffreyA - Tuesday, September 20, 2022 - link

Don't worry; the hip and happening present-day reviewers will also have their day when the wheel turns.rmfx - Friday, September 16, 2022 - link

If the stats are accurate, that's an absolutely disgusting behavior Nvidia has.Nobody could blame EVGA when witnessing such disrespect and abuse from Nvidia.

Ps: I never understood why GPUs are not manufactured under the main brand only like CPUs are?

catavalon21 - Friday, September 16, 2022 - link

It's not really close to a parallel, but what comes to mind as a difference is that video cards have much more than just a GPU processor, whereas CPU manufacturers rarely make or design the entire MoBo.The Von Matrices - Friday, September 16, 2022 - link

GPUs have lots of components other than the main ASIC. It's logical that there are AIBs whose job is to gather and assemble all these components on a circuit board. In a similar concept, Intel and AMD don't sell motherboards despite making the silicon that is the chipset.Ryan says that "Video card complexity has increased significantly over the years", which is true for the ASICs themselves, but I beg to differ when it comes to the PCBs. When I look at a modern video card I am always shocked by how few components are on the PCB. Nowadays it's just VRMs, memory chips (sometimes not even that if using HBM), and the ASICs themselves. The actual PCBs are tiny, much smaller than the heatsink and are similar in size to 1990s video cards. The circuit boards even for high end video cards used to have tons of other chips like video decoders and 2D accelerators and sometimes audio codecs. Those days are gone and there is less than ever for a AIB vendor to do.

bubblyboo - Friday, September 16, 2022 - link

Intel sold their own branded boards in the past up until Sandy Bridge or so. The list is still on their site.https://ark.intel.com/content/www/us/en/ark/produc...

They got in to ensure QC in the mobo market when 3rd parties were cutting corners, and left once 3rd parties caught up. Part of that is also because selling mobos is low margin. All chip companies still design and internally use reference boards for testing purposes, but most don't think the low margins are worthwhile to sell directly to consumers.

https://www.anandtech.com/show/6685/the-end-of-an-...