As The Demand for HBM Explodes, SK Hynix is Expected to Benefit

by Anton Shilov on April 18, 2023 9:00 AM EST

The demand for high bandwidth memory is set to explode in the coming quarters and years due to the broader adoption of artificial intelligence in general and generative AI in particular. SK Hynix will likely be the primary beneficiary of the HBM rally as it leads shipments of this type of memory, holding a 50% share in 2022, according to TrendForce.

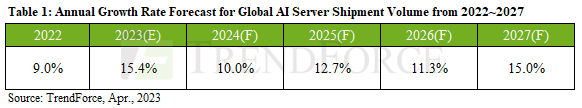

Analysts from TrendForce believe that shipments of AI servers equipped with compute GPUs like Nvidia's A100 or H100 will increase by roughly 9% year-over-year in 2022. However, they do not elaborate on whether they mean unit shipments or dollar shipments. They now estimate that the rise of generative AI will catalyze demand for AI servers, and this market will grow by 15.4% in 2023 and continue growing at a compound annual growth rate of 12.2% through 2027.

The upsurge in AI server usage will also increase demand for all types of memory, including commodity DDR5 SDRAM, HBM2e as well as HBM3 for compute GPUs, and 3D NAND memory for high-performance and high-capacity storage devices.

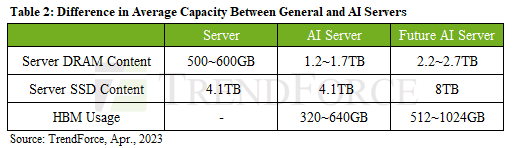

TrendForce estimates that while general-purpose servers pack 500 GB – 600 GB of commodity memory, an AI server uses 1.2 TB – 1.7 TB. In addition, such machines use compute GPUs equipped with 80 GB or more of HBM2e/HBM3 memory. Since each AI machine comes with multiple compute GPUs, the total content of HBM per box is now 320 GB – 640 GB, and it is only set to grow further as accelerators like AMD's Instinct MI300 and Nvidia H100 NVL carry more HBM3 memory.

Speaking of HBM3 adoption, it is necessary to note that SK Hynix is currently the only maker that mass produces this type of memory, according to TrendForce. As a result, as demand for this type of memory grows, it will benefit the most. Last year SK Hynix commanded 50% of HBM shipments, followed by Samsung with 40% and Micron with 10%. This year the company will solidify its positions and control 53% of HBM shipments, whereas shares of Samsung and Micron will decline to 38% and 9%, respectively, TrendForce claims.

Nowadays, AI servers are used primarily by the leading U.S. cloud service providers, including AWS, Google, Meta, and Microsoft. As more companies launch their generative AI products, they will inevitably have to use AI servers either on-prem or at AWS or Microsoft. For example, Baidu and ByteDance plan to introduce generative AI products and services in the coming quarters.

Source: TrendForce

Source: TrendForce

9 Comments

View All Comments

brucethemoose - Tuesday, April 18, 2023 - link

A year or two ago, 80GB of RAM on a single accelerator seemed silly.Now... it feels cramped. Pretty much all the hardware makers underestimated how quickly model sizes would scale.

Samus - Tuesday, April 18, 2023 - link

Except AMD. They knew memory, and bandwidth, was critical to feed modern IPC and have been pushing HBM and large caches for some time. They have a chip in prototype stage with 1GB of on-package cache.brucethemoose - Tuesday, April 18, 2023 - link

Uh I dunno about that. Sure some 128GB offerings are here/coming, but I think they would have given the MI300 a wide DDR bus if they had seen the LLM craze coming.schujj07 - Tuesday, April 18, 2023 - link

Wide DDR buses increases power consumption and PCB size. The RTX4090 has a 384bit bus with 21Gpbs GDDR6X for a total of 1TB/sec bandwidth. Going to a 512bit bus, which is really wide in GPUs, only brings that to 1.3TB/sec. The AMD MI250 has 3.2TB/sec bandwidth with HBM2e. Standard GDDR cannot get the bandwidth you get with HBM.Threska - Wednesday, April 19, 2023 - link

Higher power consumption.https://www.quora.com/Is-AMD-Vega-ultimately-a-fai...

nandnandnand - Tuesday, April 18, 2023 - link

AMD has to fix their CUDA problem or die in the LLM haze.Threska - Wednesday, April 19, 2023 - link

Die stacking is the future.https://youtu.be/5uuRduTpl4Q

DanNeely - Wednesday, April 19, 2023 - link

When they only make 20% more HBM than Samsung claiming that SK Hynix is the only company mass producing HBM sounds weird.Mashered Trader - Sunday, May 28, 2023 - link

Samsung stopped HBM production due to losing its JDLA with Netlist. The production they had was infringing. They will have to pay NLST. SK Hynix is the only producer with a licensing agreement with Netlist